Penny Budget

Funding projects without property tax

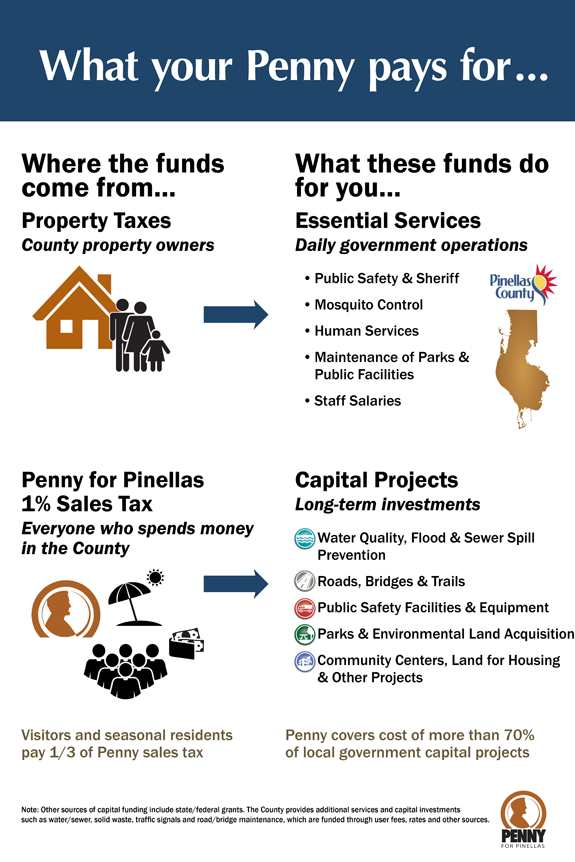

The Penny is Pinellas County’s primary funding source for governmental capital projects, covering more than 70 percent of their costs. While routine costs for maintaining roads or public parks come from the County’s general fund – primarily supported by property taxes – most of our long-term investments are supported by the Penny. Examples include projects such as the Bayside Bridge, Keystone Road, the Fred Marquis Pinellas Trail and the Public Safety Complex. The Penny is used to attract funds from other sources like state and federal agencies.

How is the Penny distributed?\

The Penny is divided between the County and our 24 cities![]() based on population. A portion of the renewed Penny is also committed to countywide investments, such as economic development infrastructure and land for more housing that’s affordable.

based on population. A portion of the renewed Penny is also committed to countywide investments, such as economic development infrastructure and land for more housing that’s affordable.

For more details, see: Penny III Distribution![]() , Penny IV Distribution

, Penny IV Distribution![]()

Learn how the Penny has been invested over the years:

- Revenue Distributions and Expenditures by Classification from 1990-2020

(as reflected on historical Penny for Pinellas website)

- Project Details from 1990-2020

(as reflected on historical Penny for Pinellas website)

Documents are supplied in PDF format ![]()

The Penny and sales tax rates

Pinellas County has a sales tax rate of 7 percent, close to the statewide average rate of 6.8 percent. Florida’s statewide sales tax rate is 6 percent, but a majority of county governments have a local sales tax of .5 to 2 percent for various purposes, including infrastructure, public hospitals, emergency services, transportation, indigent care and others.

The Penny stays in Pinellas

Did you know that 100 percent of the Penny comes back to Pinellas County for investment in projects in our community? In contrast, only a small portion (approximately 6.5 percent) of your state sales tax is returned to Pinellas County government.